Many regulated entities are required to have AML packages in place, which are often based on the 5 key pillars of AML. AML UAE works intently https://www.tadpoletraining.com/price-confidence-sell-without-ever-discounting-again/ with the AML Compliance Officer/Money Laundering Reporting Officer (MLRO) of the reporting entities, supplies relevant AML services and helps them adjust to the AML Laws and Regulations. The template has been updated to replicate member firms’ obligations underneath FINRA Rule 3310 in mild of the Financial Crimes Enforcement Network’s (FinCEN) final rule on Customer Due Diligence Requirements for Financial Institutions (CDD Rule). Registered representatives can fulfill Continuing Education requirements, view their business CRD document and carry out other compliance duties.

Aml Enterprise Threat Evaluation Template For Dnfbps In Uae

We also embody our unique AML checklist for finishing anti cash laundering checks and auditing your money laundering dangers. This is significant when you want to update threat assessments to reflect changes in your company’s risk profile and hold a compliant reporting and monitoring system in place. Implementing an AML risk evaluation template is an important step towards strengthening your AML compliance program. By providing a structured framework for threat assessment, the template may help companies identify potential dangers, implement efficient controls, and preserve compliance with AML rules. For extra assets on AML threat assessment, try our aml danger evaluation guidelines, aml risk evaluation software, and aml threat evaluation matrix. Included in building a robust framework is a suspicious activity risk evaluation that identifies these risks and measures the effectiveness of applicable preventative and detective controls which monetary establishments worldwide need to deal with.

What Are The Important Thing Compliance Processes Of An Aml Risk Assessment?

For distinctive situations, the chance assessment builder allows you to create absolutely customized templates. AML UAE is dedicated to helping the designated entities comply with AML laws and implement the robust AML compliance framework to mitigate the monetary crime danger successfully. As the first step to this journey, we help corporations in Entity-wide Risk Assessment, design the appropriate control measures to mitigate Enterprise-wide danger, and customize AML insurance policies.

The WBG doesn’t symbolize that the NRA Toolkit or any data or results derived from the NRA Toolkit are correct or complete or applicable to a user’s circumstances and accepts no legal responsibility in relation thereto. The WBG shall not have any liability for errors, omissions, or interruptions of the NRA Toolkit. Many of our purchasers mandate the Themis Risk Assessment to their suppliers and third-parties as a half of their core procurement coverage. With the introduction of compliance regulations such as the EU Supply Chain Law, that is set to become obligatory. If you wish to use our insurance policies or toolkits as a part of your personal service or consultancy provision, we provide a singular Consultant Licence Scheme that permits you to save time, money and assets.

To assist you in assessing your business’s publicity to ML threat, we current the AML Business Risk Assessment template, capturing the crucial parameters on which such assessment must be primarily based and the recommended methodology. AML Business Risk Assessment can additionally be called Anti-Money Laundering Entity-wide Risk Assessment or Enterprise-wide Risk Assessment. Additionally, the evaluate course of must also consider feedback from various stakeholders, together with compliance staff, senior management, and exterior auditors, to ensure that the template remains strong and complete. The Risk Assessment Platform has been tailor-made to handle ML/TF dangers across a quantity of sectors, together with monetary providers, gaming and wagering, gatekeeper professions, high-value goods sellers, professional companies and a lot of other industries.

The BSA/AML threat assessment course of additionally permits the bank to raised establish and mitigate any gaps in controls. The BSA/AML threat assessment should provide a comprehensive evaluation of the bank’s ML/TF and other illicit monetary exercise dangers. Documenting the BSA/AML danger assessment in writing is a sound apply to effectively talk ML/TF and different illicit monetary exercise risks to appropriate financial institution personnel.

You should help your threat evaluation by documenting the main dangers, together with how they relate to your corporation (the general thought process). For instance, PEPs are thought of to be higher-risk, in addition to skilled service suppliers, who should be verified and screened to ensure that these individuals or entities aren’t on any sanction lists. This contains creating and implementing insurance policies and procedures for customer due diligence, transaction monitoring, and reporting suspicious activities. It is also important to provide regular training to employees on AML/CFT insurance policies and procedures. To create an efficient AML/CFT danger assessment template, it’s essential to incorporate several key components.

The NRA Toolkit incorporates guidance manuals; Excel worksheets and the formulation therein; PowerPoint shows; and another materials supplied as part of the NRA Toolkit. Jurisdictions are suggested to make use of the NRA Toolkit with technical assistance from the WBG to ensure correct utility. Using Firmcheck’s AML risk assessment template, you can regulate questions to suit the specific compliance needs of your firm or regulatory requirements.

- Product demos of our AML danger assessment software tool are open to monetary institutions worldwide.

- For distinctive situations, the chance evaluation builder enables you to create absolutely customized templates.

- Tools corresponding to aml danger evaluation software can even streamline this process, making it extra environment friendly and reliable.

- Documenting the BSA/AML risk evaluation in writing is really helpful to effectively talk risks to appropriate financial institution personnel.

You get complete peace of thoughts when you realize your anti-money laundering compliance is dealt with by AML UAE. We take away your AML compliance burden with our AML consulting providers to help you focus on your business. Configure risk assessments that address all required danger areas like geography, client, transaction type, and more. Establish a flexible framework aligned to your compliance policies and weigh standards based mostly on your risk urge for food. We have partnered with Arctic Intelligence, a multi-award-winning cloud-based expertise provider specialising in enterprise-wide monetary crime danger assessment solutions. At the identical time, organisations must pay shut attention to the warning signs of cash laundering and adjust their insurance policies, controls, and procedures accordingly.

It is a testomony to our dedication to helping businesses navigate the complicated panorama of economic danger management. Compliance specialists advocate updating your danger management practices and making modifications to your AML threat assessment at least every year. Regularly reviewing all AML procedures helps make certain that your small business is compliant with AML legal guidelines and that each one risk profiles are correct and up-to-date, as there may be modifications in your relationship with a consumer. For instance, the use of crypto belongings and virtual currencies, in addition to trusts or financial expertise providers are additionally thought-about to be higher-risk activities.

The geographic areas the place a business operates or where its prospects are based mostly can considerably affect the chance of encountering cash laundering actions. The geographic risk rating evaluates this probability for different regions and is a critical element of the AML threat assessment template (PSPLab). This involves categorizing clients primarily based on danger levels similar to low, medium, or high. This classification assists in figuring out the level of due diligence required for every buyer class and is a key facet of the AML risk assessment template. Adherence to those laws requires the use of a complete AML risk evaluation template. A strong template must be regularly up to date to mirror modifications in regulations, business activities, and exterior risk elements, making certain that the compliance program remains efficient and up-to-date.

Risk assessments are a key component of any agency’s anti-money laundering (AML) tool kit and might help companies to measure the chance that they may inadvertently help or have interaction in criminal behaviour. Know Your Compliance Limited have been developing regulatory compliance insurance policies and procedures for nearly 10 years. Helping over 7500 organisations to fulfill their compliance wants in a range of areas, we are market leaders in offering regulatory templates. Know Your Compliance Limited are the UK’s main supplier of regulatory compliance templates.

By utilizing an AML risk assessment template, organizations can determine these potential risks, assess their impression, and implement methods to mitigate them effectively. This strategy assists in identifying ML/TF and different illicit financial activity risks, helping them develop acceptable internal controls, processes, and procedures to adjust to regulatory requirements. Every product and repair offered by a enterprise carries a potential risk for money laundering.

All information transmitted and saved by way of the First AML platform is encrypted each in transit and at relaxation using the industry normal AES-256 encryption algorithm to encrypt information. Equip employees to make risk-aware decisions by sharing evaluation data, and store all of it for future reference. You can continue to rely on the world-class Investment Accounting software and services you’ve come to expect, plus all that Abrigo has to supply. This process ought to be reviewed each 12 to 18 months, or if a business undergoes any vital changes, and any needed modifications to internal procedures made. The WBG will not be responsible or liable to customers of the NRA Toolkit or to some other get together for any information or outcomes derived from using the NRA Toolkit for any business or coverage choices made in connection with such utilization.

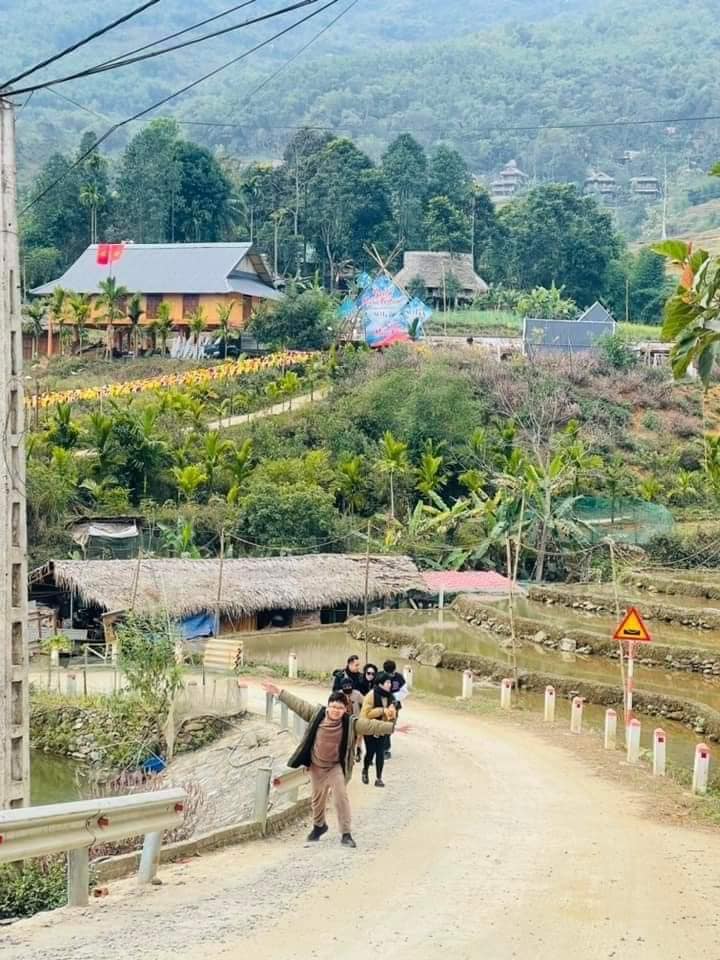

Khu vui chơi Water Fun nằm ở khu nhà hàng Hồng Tự, biển Hải Hòa, Tĩnh Gia, tỉnh Thanh Hóa. Đây là khu vui chơi công viên nước đầu tiên có tại Thanh Hóa với nhiều trò chơi hấp dẫn. Với sự đầu tư quy mô lên đến 8000m2, khu du lịch chắc chắn là địa điểm không thể thiếu trong chuyến du lịch biển Hải Hòa.

Khu vui chơi Water Fun nằm ở khu nhà hàng Hồng Tự, biển Hải Hòa, Tĩnh Gia, tỉnh Thanh Hóa. Đây là khu vui chơi công viên nước đầu tiên có tại Thanh Hóa với nhiều trò chơi hấp dẫn. Với sự đầu tư quy mô lên đến 8000m2, khu du lịch chắc chắn là địa điểm không thể thiếu trong chuyến du lịch biển Hải Hòa.