Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. Before making adjustments, it is important to understand first what adjustments are and why they are needed.

Do you already work with a financial advisor?

For example, if an adjustment entry is made to increase revenue, this will increase the business’s profitability for that period. Conversely, if an adjustment entry is made to increase expenses, this will decrease the business’s profitability for that period. Allowance for doubtful accounts is an estimate of the amount of accounts receivable that may not be collected.

Allowance for Doubtful Accounts

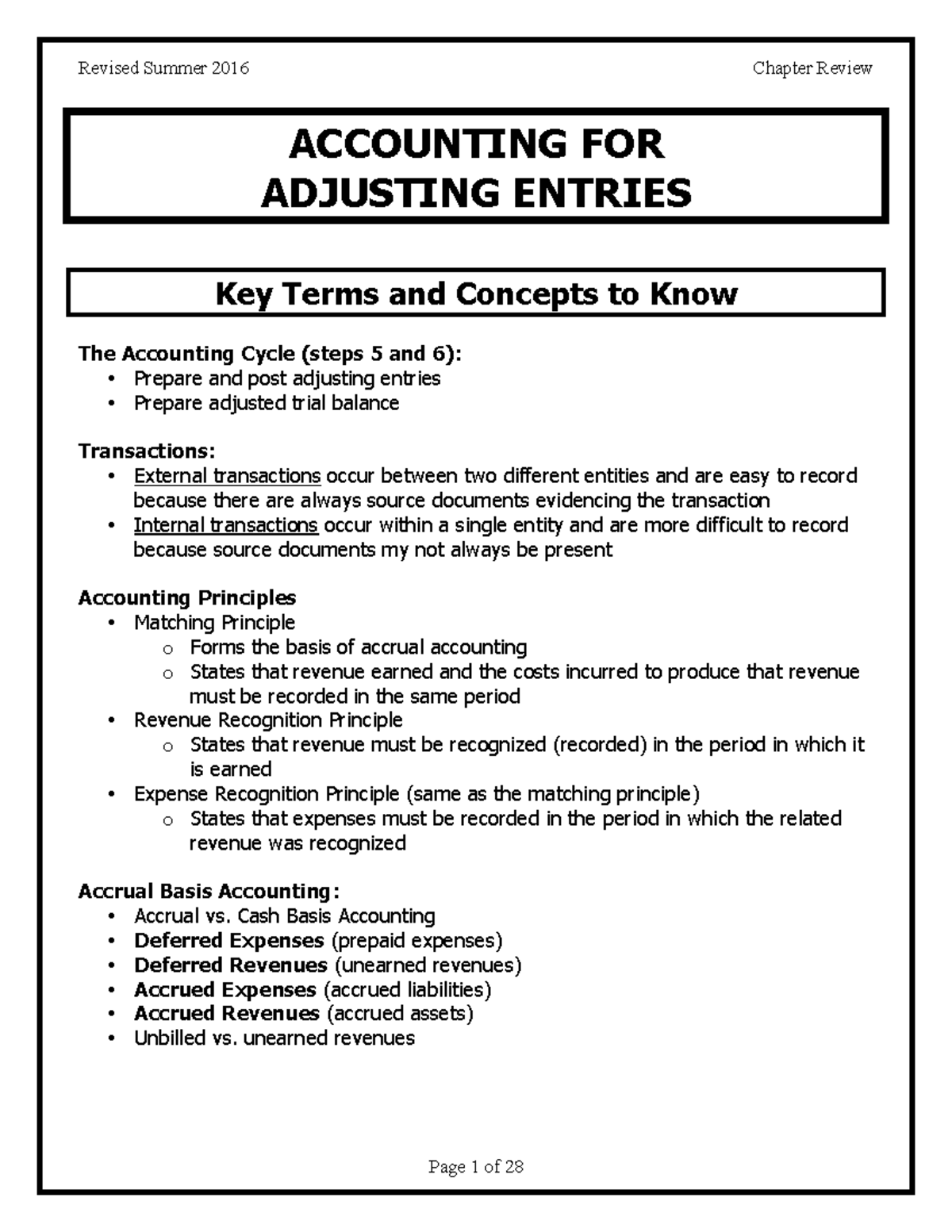

For this example, the accountant would record an equal amount of revenue for each of the six months to reflect that the revenue is earned over the whole period. The actual cash transaction would still be tracked in the statement of cash flows. Recording transactions in your accounting software isn’t always enough to keep your records accurate. If you use accrual accounting, your accountant must also enter adjusting journal entries to keep your books in compliance. By recording these entries before you generate financial reports, you’ll get a better understanding of your actual revenue, expenses, and financial position. Adjustment entries are accounting entries made at the end of an accounting period to record transactions that have occurred but have not yet been recorded.

Everything to Run Your Business

In our example, assume that they do not get paidfor this work until the first of the next month. The salary theemployee earned during the month might not be paid until thefollowing month. For example, the employee is paid for the priormonth’s work on the first of the next month. The financialstatements must remain up to date, so an adjusting entry is neededduring the month to show salaries previously unrecorded and unpaidat the end of the month. The company has accumulated interest during the periodbut has not recorded or paid the amount.

Sometimes companies collect cash from their customers for goods or services that are to be delivered in some future period. Such receipt of cash is recorded by debiting the cash account and crediting a liability account known as unearned revenue. At the end of the accounting period, the unearned revenue is converted into earned revenue by making an adjusting entry for the value of goods or services provided during the period.

Part 2: Your Current Nest Egg

- Except, in this case, you’re paying for something up front—then recording the expense for the period it applies to.

- Such receipt of cash is recorded by debiting the cash account and crediting a liability account known as unearned revenue.

- The accounting period is the period of time for which financial statements are prepared, usually one year.

- For instance, using the straight-line method for an asset that experiences rapid wear and tear may understate the depreciation expense in the early years and overstate it in the later years.

- It represents the amount that has been paid but has not yet expired as of the balance sheet date.

Interest Receivable increases (debit) for $1,250 becauseinterest has not yet been paid. Interest Revenue increases (credit)for $1,250 because interest was earned in the three-month periodbut had been previously unrecorded. During theyear, it collected retainer fees totaling $48,000 from clients.Retainer fees are money lawyers collect in advance of starting workon a case. When the company collects this money from its clients,it will debit cash and credit unearned fees.

For example, if an adjustment entry is made to increase the fair value of stock options that were granted to employees, this will increase the amount of compensation expense that the business records. When cash is received it’s recorded as a liability since it hasn’t been earned yet by the business. Over time, this liability is turned into revenue until it’s fully earned. The other deferral in accounting is the deferred revenue, which is an adjusting entry that converts liabilities to revenue. Accrued expenses are expenses made but that the business hasn’t paid for yet, such as salaries or interest expense.

Accrued expenses are expenses incurred in aperiod but have yet to be recorded, and no money has been paid.Some examples include interest, tax, and salary expenses. For example, a company performs capital expenditures and other cash needs for a business landscaping services in theamount of $1,500. Atthe period end, the company would record the following adjustingentry. The unadjusted trial balance may have incorrect balances in someaccounts.

The company recorded this as a liability because itreceived payment without providing the service. Assume that as ofJanuary 31 some of the printing services have been provided. Since a portion of the service wasprovided, a change to unearned revenue should occur. The companyneeds to correct this balance in the Unearned Revenue account. Insurance Expense, Wages Expense, Advertising Expense, Interest Expense are expenses matched with the period of time in the heading of the income statement.

The income statement is also referred to as the profit and loss statement, P&L, statement of income, and the statement of operations. The income statement reports the revenues, gains, expenses, losses, net income and other totals for the period of time shown in the heading of the statement. If a company’s stock is publicly traded, earnings per share must appear on the face of the income statement.

Comments